reit tax advantages canada

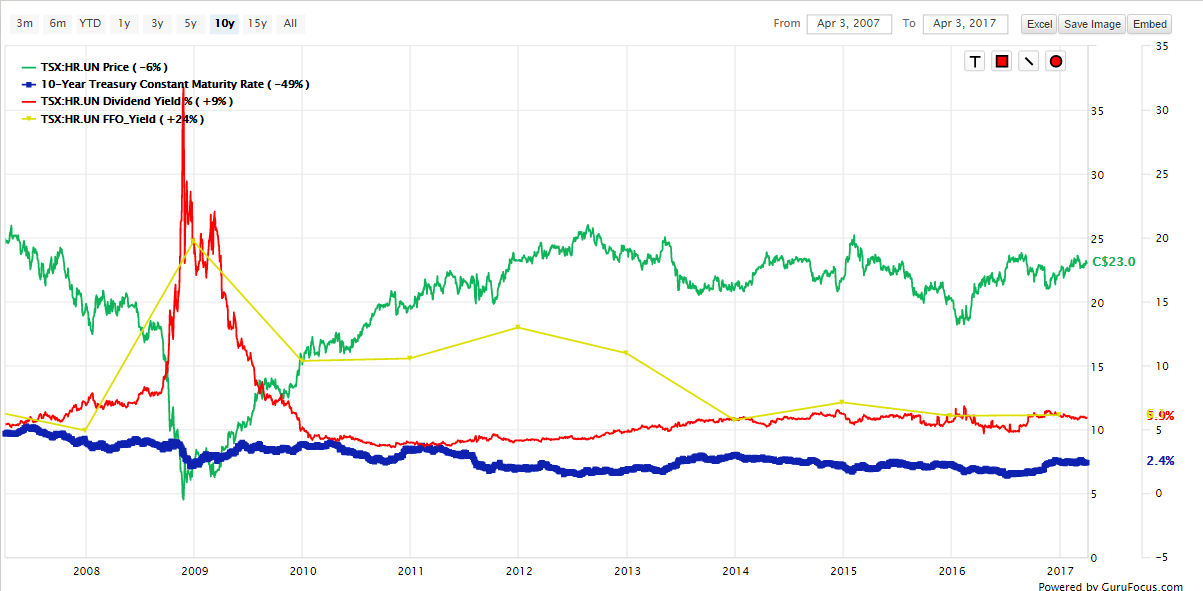

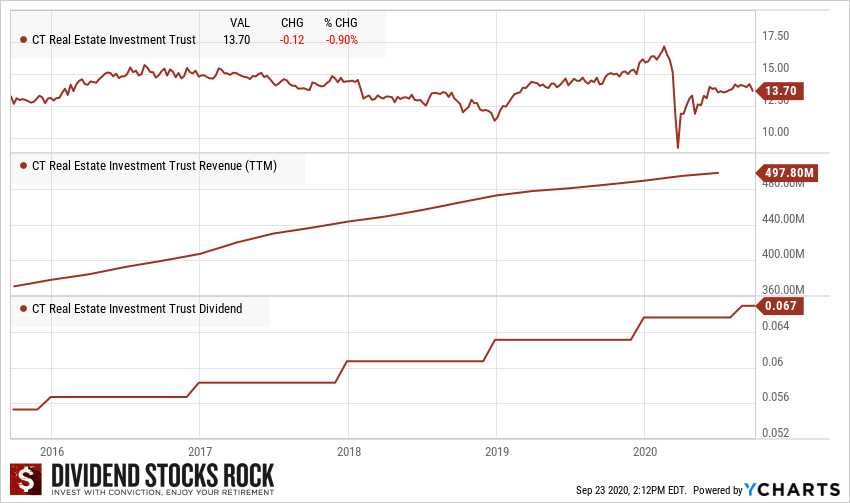

Benefits and risks. In the RioCan example above you can see a pretty large.

Introduction To Canadian Reits Seeking Alpha

Heres the simple math.

. Reit tax advantages canada. This is in comparison to the roughly 10 return of the SP 500 and the 6 8 return of private real estate funds during the same period. The 542 of my dividends that are qualified.

Preferred shares in addition to five. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. In Canada a REIT is not taxed on income and gains from its property rental business.

It owns and operates a portfolio of healthcare real estate infrastructure such as medical office buildings hospitals and. The pass-through deduction allows REIT investors to deduct up to 20 of their dividends. Theres a better way to invest in real estate.

Buy real estate investment trusts REITs. Growth investors While the first two priorities are stability and income distribution. Since their introduction to Canada REITs have become an attractive onshore tax-efficient vehicle for investors.

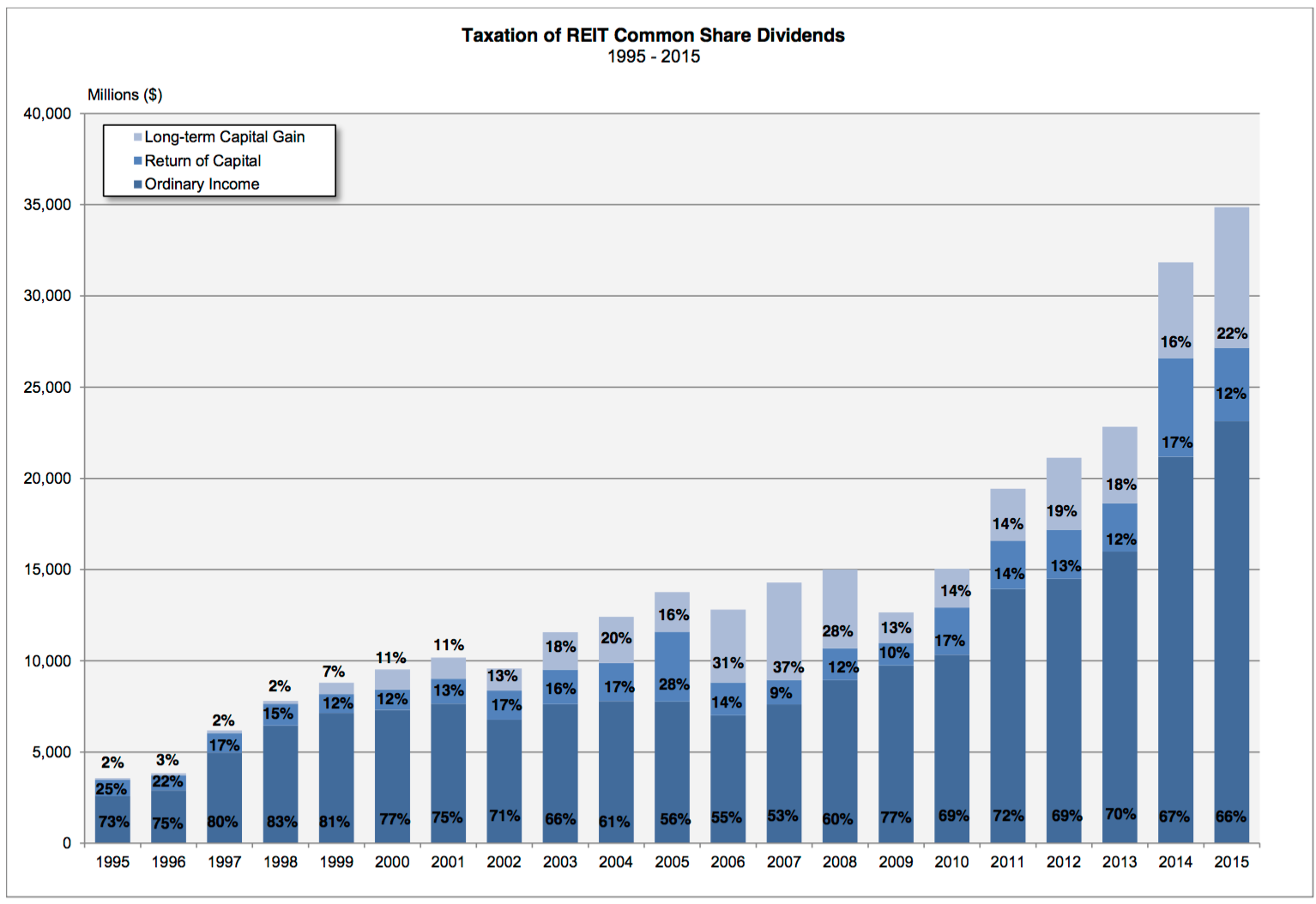

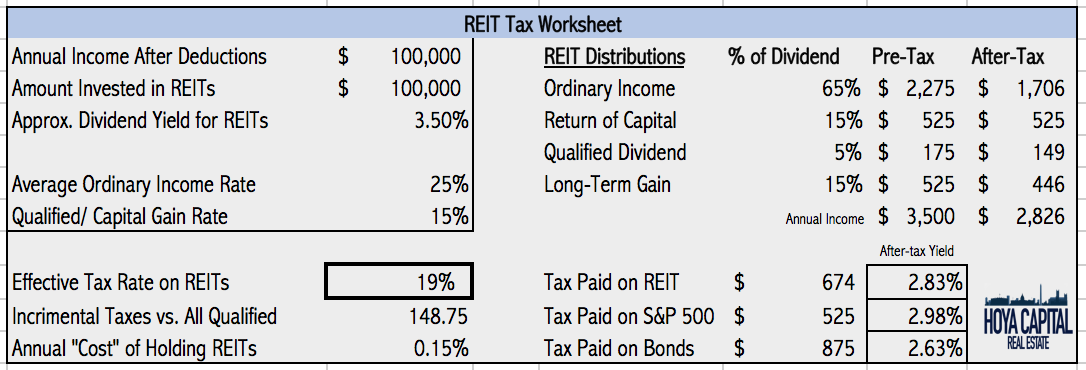

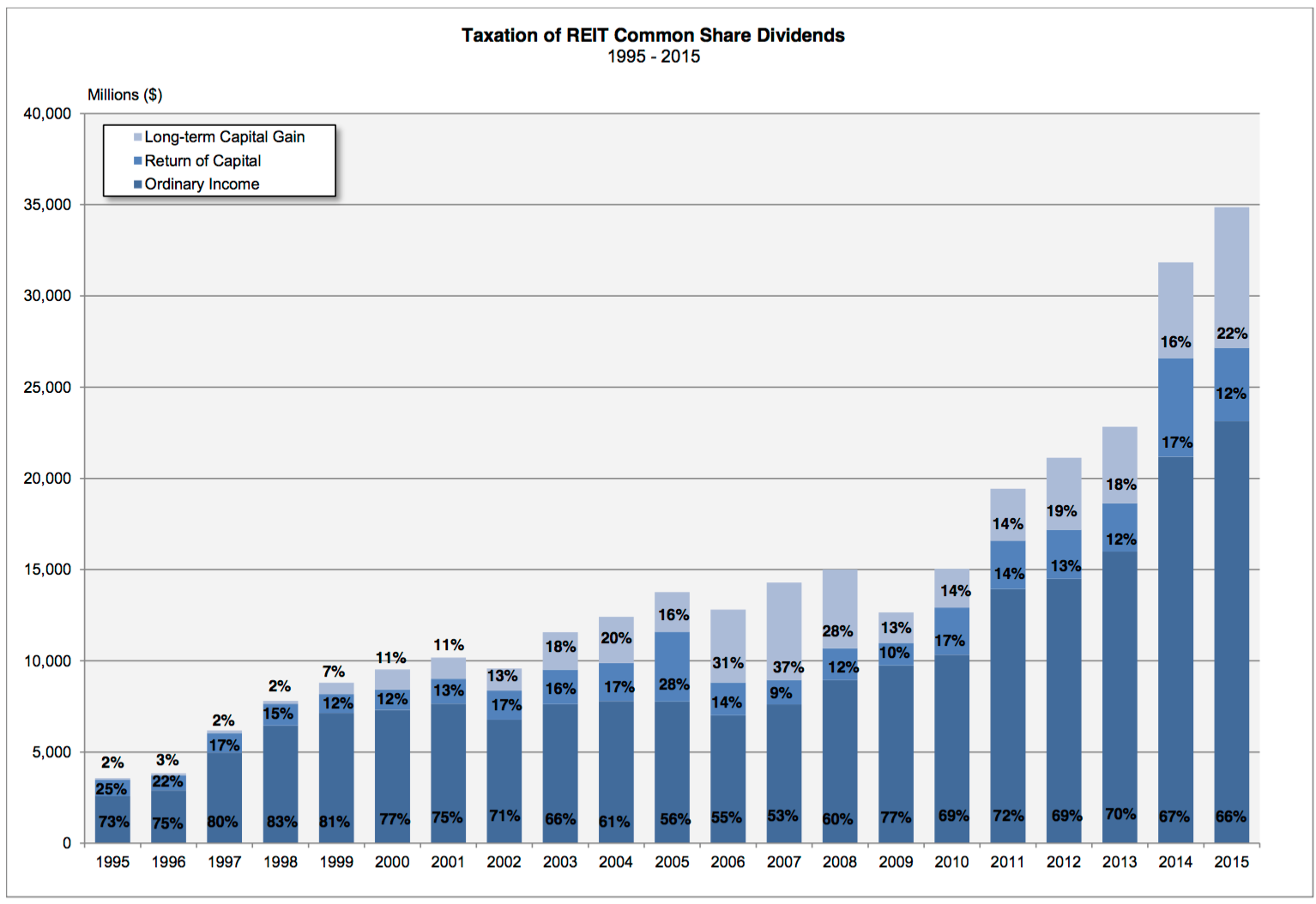

There is however an important exception to the new rulesReal Estate Investment Trusts REITs but only if they meet certain conditions. Depreciation and Return of Capital. That means that youre saving up to 740 annually on 10000 of REIT dividends.

Get your free copy of The Definitive Guide to Retirement Income. 1 pre-tax income flows through to investors 2 investors get favourable tax treatment on the income and 3 a com-ponent of the tax obligation is deferred until the units are sold. The 293 billion REIT is the lone real estate stock in the cure sector.

With some REITs having high transaction and management fees this can be a burden. Sit back and collect rent. Here are the benefits.

The 542 of my dividends that are qualified. Investors seeking tax benefits REITs offer three major tax benefits. In many countries REITs enjoy certain tax advantages for instance in Canada they arent taxed on gains from property and rental incomes as long as they meet certain criteria in relation to distributions and hold only qualified properties.

Real estate investment trust REIT A trust is a REIT for a tax year if it is resident in Canada throughout the year and meets a number of other conditions including all of the following. Real estate trusts are a different animal from typical corporations. The reduction in adjusted cost base ACB is what creates a tracking challenge.

The effect of the new tax is to treat these entities like corporations and eliminate their tax advantage. REIT Tax Benefits No. Fundrise just delivered its 21st consecutive positive quarter.

In the case of Canada a REIT does not pay business tax as long as its taxable income is distributed to unit holders. Capital gains taxes in Canada may inhibit REIT growth by preventing trusts from efficiently. At least 90 of the trusts non-portfolio properties must be qualified REIT properties.

Buying REIT units is. Investors invest in REITs mainly for higher income and for long-term growth. Real estate investment trust REIT A trust is a REIT for a tax year if it is resident in Canada throughout the year and meets a number of other conditions including all of the following.

If it pays a dividend to. In principle REITs like the business income and royalty trusts of yesteryear improve capital market efficiency in this sense. The clear advantage of a REIT is to reduce corporate and personal taxes on income paid to investors 1 A report from Grant Thornton LLP agrees.

Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. REITs offer certain tax advantages to encourage this investment. A REITs can be very profitable as well as a growth enterpriseA high-yield dividend starts in the range of 25 for the top 20 Canadian REITs in the market capSmartCentres REIT SRU had a 16 yield when compared to the SP 500The next few years will be characterized by an increasing number of positive.

The clear advantage of a REIT is to reduce corporate and personal taxes on income paid to investors. The REIT collects rental income pays its expenses and then distributes almost all its remaining incomeusually 85 to 95to unit. Instead shareholders are taxed on a REITs property income when it is distributed and some investors may be exempt from tax.

The 293 billion REIT is the lone real estate stock in the cure sector. Are Reits Good Investments Canada. How is the REITs market evolving in Canada.

From 1977 to 2010 REITs have returned more than 12 annually. It owns and operates a portfolio of healthcare real estate infrastructure such as medical office buildings hospitals and. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income.

Wachovia Hybrid and Preferred Securities WHPPSM Indicies. REIT in the limelight. In anticipation of the new tax many income trusts converted to corporations over the past few years.

Starting in tax year 2018 an additional benefit has been added to REITs thanks to tax reform. Since their introduction to Canada REITs have become an attractive onshore tax-efficient vehicle for investors 2. REIT Tax Benefits No.

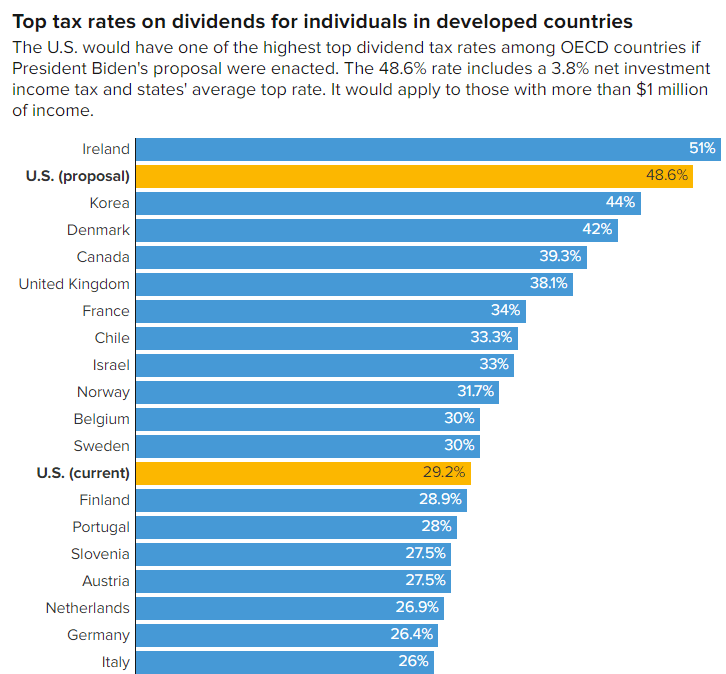

Investors in the top tax bracket can potentially see their tax bill for dividends go from 37 to 296. REITs are much lower risk with a proven history of outperforming direct real estate investing. REITs also help investors diversify their.

REIT Taxation in Canada Income Tax Treatment on Investment AccountsIncome tax on REITs is actually pretty simple to understand however the tracking of the details year after year is where the challenge is. On the subject of REIT taxation an article in the Financial Post states. It requires a good stock tracking system.

Ad Learn the basics of REITs before you invest any of your 500K retirement savings.

Reits Canada Still Offers Tax Advantages For These Investments

Reits Vs Real Estate Mutual Funds What S The Difference

The Taxman Cometh A Look At The Tax Efficiency Of Reits Nysearca Vnq Seeking Alpha

Reits Explained For Canadians Real Estate Investing For Beginners Passive Income Investing Youtube

The Taxman Cometh A Look At The Tax Efficiency Of Reits Nysearca Vnq Seeking Alpha

Top 3 Canadian Reits For 2020 And Why Riocan Is Not Part Of It Seeking Alpha

Reit Taxation A Canadian Guide

Reits Canada Still Offers Tax Advantages For These Investments

/https://www.therecord.com/content/dam/thestar/business/2022/05/03/canadas-largest-landlords-have-saved-billions-through-tax-exemptions-according-to-a-new-analysis-is-ottawa-about-to-end-the-party/capreit.jpg)

Canada S Largest Landlords Have Saved Billions Through Tax Exemptions According To A New Analysis Is Ottawa About To End The Party Therecord Com

Reit Taxation A Canadian Guide

Reit Tax Rule Changes Should You Still Buy Them

Residential Reits In Canada Lag As Trudeau Weighs Investor Curbs Bnn Bloomberg

Biden S Tax Proposal Impact On Stocks And How To Use Reits For Tax Advantages Seeking Alpha

/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

Are Reits Good Investments In Canada The Motley Fool Canada

Reits Explained For Canadians Real Estate Investing For Beginners Passive Income Investing Youtube

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends